Pakistan is quickly becoming

home to more

foreign terrorists than ever before. This is not helped by the

truce being cut between the government and tribal groups from the northwestern FATA region. Baitullah Mehsud, a warlord widely suspected of plotting Benazir Bhutto's assassination, is leading the charge. The deal comes fresh on the heels of a suicide bomb attack on the Indian embassy in Kabul that

killed 41 civilians and injured 139.

While the US demurly

denies any direct link between Pakistan and the bombing, the Afghan government has been more than forthright sharing its belief that Pakistan, specifically their ISI intelligence arm, was behind the attack. The rumor mill is awash with tales of varying veracity but one thing is certain. The possibility of success in Afghanistan is directly hinged on a working relationship between its two tenuous neighbors: India and Pakistan.

The lack of news from Afghanistan - a $4 billion G8

pledge for Afghani security and development was pushed to the back page this week - reflects a worrying sense of idleness and complacency. The situation in Afghanistan is growing worse by the day and requires delicate maneuvering by its neighbors to prevent any further decline.

The relationship between India and Pakistan is shaky at best. Foreign pressure and nuclear co-habitation are the two main reasons they still talk and flare-ups, such as the recent

protests in Kashmir, are still common, though violence is at an all-time low. But if there is to be success in Afghanistan, Pakistan and India must restrain their public voices and defuse the situation using diplomatic back channels. Their relationship is too perilous to permit unfounded nationalist rhetoric.

Regional stability is at risk but Afghanistan also needs all the help it can get - especially from two such powerful players. The country's development and freedom requires the military cooperation of Pakistan and the economic support and guidance of India. Without these two pillars, peace may never take hold. The bombing represents many things but not a personal attack on India; the Taliban agents carrying out such work are not Pakistani but Chechnians, Uzbeks, and Arabs. Their fight is a global one. India must realize this and work with Pakistan to stamp out such extremism in Afghanistan. The US must help.

It is unwise and unfair for the US to openly

criticize the tribal negotiations. Though more

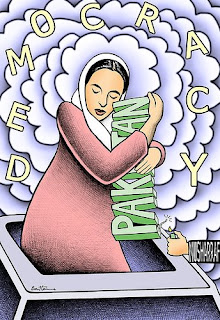

jihadis are now in the FATA, this reflects a perceived chance of success in Afghanistan and one of defeat in Iraq. In this case, correlation is not causation. The negotiations may not be to the US' liking but after supporting an autocratic ruler like Musharraf for so long we must be willing to back a democratically elected government, regardless of whether we like their actions. If Karzai can maintain his grasp on Afghanistan and Pakistan can bring quiet to the FATA, even through devolution of power, then the billions of development dollars pouring into both countries may be put to some use. Without security, and at least the semblance of due political process, extremists will continue to prevent any advancement or peace. NATO forces are already planning their withdrawal: shouldn't they at least leave the Afghans a chance of success?

I've written about the importance of internet transparency before. It's an issue that does not get nearly enough attention; unless of course international reporters find themselves blocked from websites in Beijing.

I've written about the importance of internet transparency before. It's an issue that does not get nearly enough attention; unless of course international reporters find themselves blocked from websites in Beijing.